Imagine putting all your money into one investment—only to see it crash overnight. Sound risky? It is.

That’s why diversification is the golden rule of investing. Whether you’re into cryptocurrency trading, forex trading strategies, or emerging markets, spreading your investments across different asset classes can increase potential returns while managing risk.

Why Diversification Matters Now More Than Ever

Markets are more unpredictable than ever. Bitcoin surged to $69,000 before crashing to $16,000, only to recover again. Forex markets are constantly impacted by inflation and interest rate hikes. And with the rise of decentralized finance platforms (DeFi) and AI-driven trading, new investment opportunities emerge every day.

But how do you balance crypto vs forex trading? How can you make sure your portfolio is optimized for both growth and stability?

What You’ll Learn in This Guide

✅ How to structure a diversified portfolio using crypto, forex, and other assets

✅ The best strategies for trading for beginners and experienced investors

✅ How to integrate automated trading bots and AI-driven forex trading strategies for hands-free investing

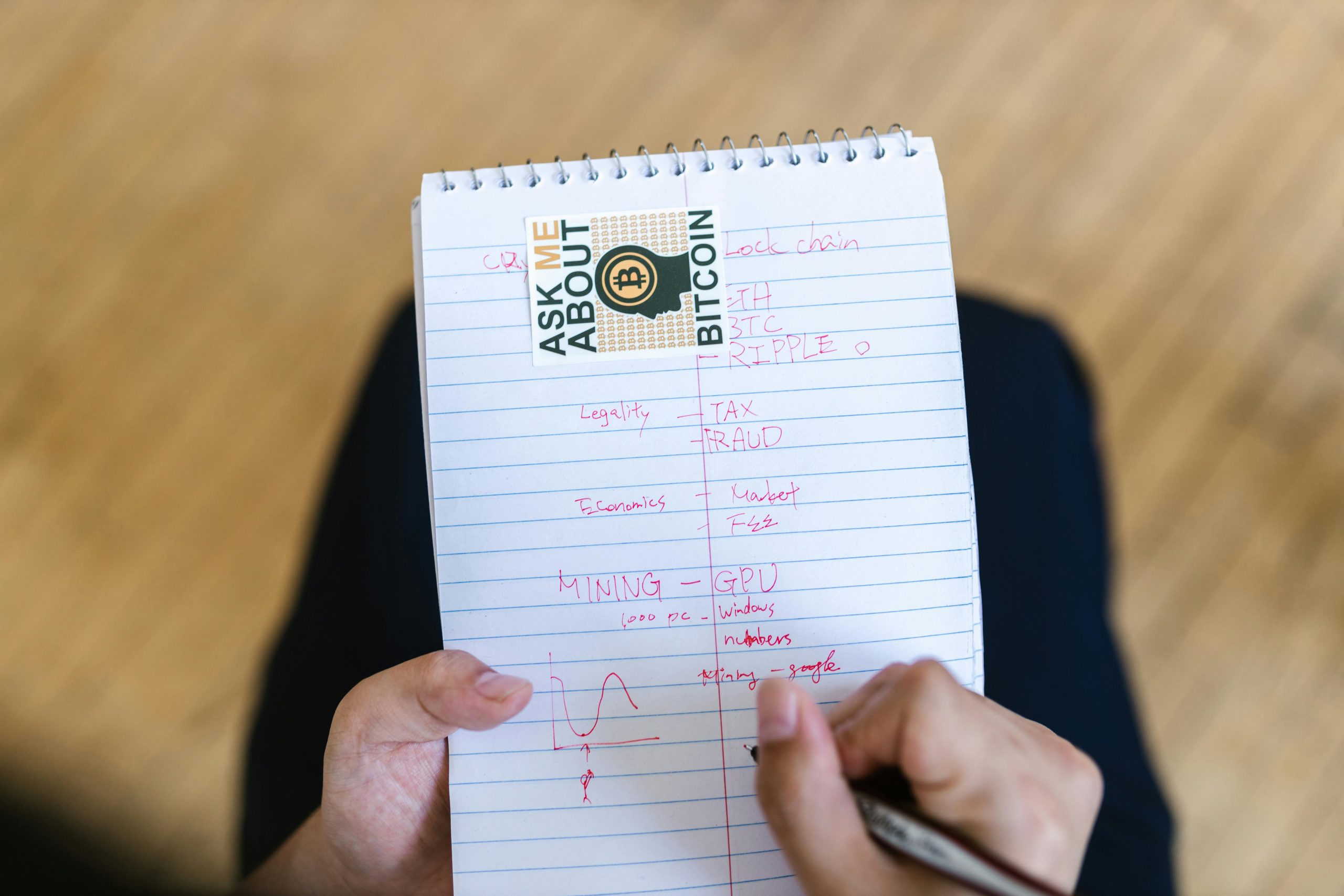

✅ The role of blockchain technology in trading and its future impact

✅ The best trading platforms for managing multiple asset classes efficiently

By the end of this article, you’ll have a clear strategy for building wealth in 2025 and beyond—whether you want to buy Bitcoin, trade forex profitably, or invest in emerging opportunities. Let’s dive in. 🚀

Building a Diversified Investment Portfolio: Crypto, Forex, and Beyond

A well-diversified investment portfolio isn’t just about spreading your money across different assets—it’s about balancing risk, maximizing returns, and adapting to market trends. Whether you’re interested in cryptocurrency trading, forex trading strategies, or alternative investments, diversification can help you build long-term wealth while reducing risk exposure.

In this section, we’ll break down how to structure a diversified portfolio that includes crypto, forex, and beyond, ensuring you’re prepared for market shifts in 2025 and beyond.

1. The Core Elements of a Diversified Portfolio

A solid portfolio should include a mix of high-risk, medium-risk, and low-risk assets to balance potential returns and stability. Here’s a strategic breakdown:

Asset Type | Risk Level | Investment Purpose |

Cryptocurrency | High | Growth, speculation, long-term wealth |

Forex Trading | Medium | Active trading, hedge against inflation |

Stocks & ETFs | Medium | Long-term stability, dividend income |

Commodities (Gold, Silver, Oil) | Low | Hedge against economic uncertainty |

Bonds & Fixed Income | Low | Security, steady returns |

Alternative Investments (NFTs, DeFi, P2P lending) | High | Early adoption opportunities |

📌 Pro Tip: Diversifying across crypto vs forex trading ensures you capitalize on short-term gains while holding long-term assets for stability.

2. Cryptocurrency: A High-Risk, High-Reward Growth Asset

Cryptocurrencies are among the most volatile assets, but they offer massive potential for long-term gains. If you’re looking to buy Bitcoin in 2025 or invest in emerging blockchain technology in trading, here’s how to allocate wisely:

📌 Key Crypto Investment Strategies:

✅ Long-Term Holdings (HODLing): Invest in top cryptocurrency for long-term investments 2025, like Bitcoin, Ethereum, and Solana.

✅ DeFi Investments for Beginners: Allocate a percentage to decentralized finance platforms (DeFi), such as yield farming and crypto staking rewards platforms.

✅ Low-Cap Growth Coins: Consider low-cap cryptocurrencies to invest in 2025 with strong fundamentals and adoption potential.

✅ Automated Trading Bots: Use AI-driven forex trading strategies and trading robots for beginners to automate trades.

3. Forex Trading: A Strategic Hedge Against Market Volatility

While crypto offers high returns, forex trading provides stability and liquidity, making it a crucial part of a diversified investment portfolio.

📌 How to Profit from Forex in a Diversified Portfolio

✅ Short-Term Forex Speculation Strategies: Use leverage trading in forex to maximize small price movements.

✅ Hedging Against Inflation: Forex can protect against currency devaluation in emerging markets forex trading opportunities.

✅ Forex Trading Bots: Automate trades with AI-driven forex trading strategies and best forex trading apps.

✅ Copy Trading for Beginners: Use best platforms for copy trading to mirror the strategies of successful forex traders to follow.

4. Stocks, Commodities & Alternative Investments

Besides crypto and forex, a strong portfolio should also include:

📈 Stocks & ETFs

✅ Index funds & tech stocks (e.g., S&P 500, Apple, Microsoft) for long-term stability.

✅ Dividend stocks for passive income.

🏅 Commodities (Gold, Silver, Oil)

✅ Gold & Silver: Hedge against inflation and economic downturns.

✅ Oil & Energy: Exposure to global energy markets.

🎨 NFTs & Blockchain Innovations

✅ NFTs and Blockchain for Traders: Invest in NFT gaming platforms, digital real estate, and blockchain-based assets.

✅ P2P Crypto Exchanges & DeFi: Earn through peer-to-peer cryptocurrency trading and crypto lending platforms.

5. How to Manage Risk in a Diversified Portfolio

Diversification reduces overall risk, but proper risk management ensures you don’t lose more than you can afford.

📌 Key Risk Management Strategies:

✅ Portfolio Rebalancing: Regularly adjust allocations based on market conditions.

✅ Stop-Loss Orders: Use forex risk management strategies for beginners to protect against sudden losses.

✅ Cold Storage for Crypto: Secure long-term holdings in hardware wallets instead of exchanges.

✅ Tax Planning: Optimize investments with tax-efficient crypto trading strategies.

Transition to the Final Section: What’s Next?

Now that you know how to build a diversified investment portfolio, the next step is putting it into action.

✅ How do you choose the best trading platforms for managing multiple assets?

✅ Which automated trading bots and copy trading platforms work best for passive investing?

✅ How do you track performance and adjust your strategy for long-term financial freedom?

🚀 Stay with us for the final section, where we’ll help you take action and build your wealth for the future!

Your Path to Financial Growth: The Power of a Diversified Portfolio

Building wealth isn’t about chasing the next big thing—it’s about strategic diversification, smart risk management, and long-term vision. By combining cryptocurrency trading, forex trading strategies, and alternative investments, you create a resilient portfolio that thrives in any market condition.

If you’ve followed this guide, you now have a blueprint for building a diversified investment portfolio. Whether you’re looking to buy Bitcoin in 2025, profit from forex trading, or explore DeFi investments for beginners, your success will depend on how well you balance risk and opportunity.

Where Do You Go from Here?

Success in investing isn’t about perfection—it’s about continuous learning, adapting, and making informed decisions. Here’s how to take action today:

📌 Open an account on one of the best trading platforms to start investing in crypto, forex, or traditional assets.

📌 Follow expert strategies from top crypto influencers 2025 and successful forex traders to follow.

📌 Automate your trades with AI-driven forex trading strategies or trading robots for beginners.

📌 Educate yourself further with free forex trading webinars and best crypto trading YouTube channels.

📌 Track and adjust your portfolio based on cryptocurrency trends 2025 and emerging markets forex trading opportunities.

Final Thought: The Future Belongs to Those Who Take Action

The difference between those who build wealth and those who miss out is simple—action. Markets evolve, opportunities emerge, and smart investors are always one step ahead.

🚀 Are you ready to take control of your financial future?

📢 Start now—explore investment opportunities, subscribe to expert-led trading strategies, and share this guide with fellow investors who are ready to build long-term wealth.

The next financial breakthrough is just around the corner. Will you be prepared? 🚀

- All Posts

- Crypto / Forex